CONNECTICUT, USA — President Joe Biden’s student loan relief plan was on the minds of many people in Connecticut Wednesday, from recent graduates and young professionals to parents helping their kids pay back debt.

“As someone who is currently in law school and is looking to be in the public interest sector, it’s going to be pretty hard to pay back my student loans from undergrad already, so any little bit helps," Olivia Jones from West Hartford said.

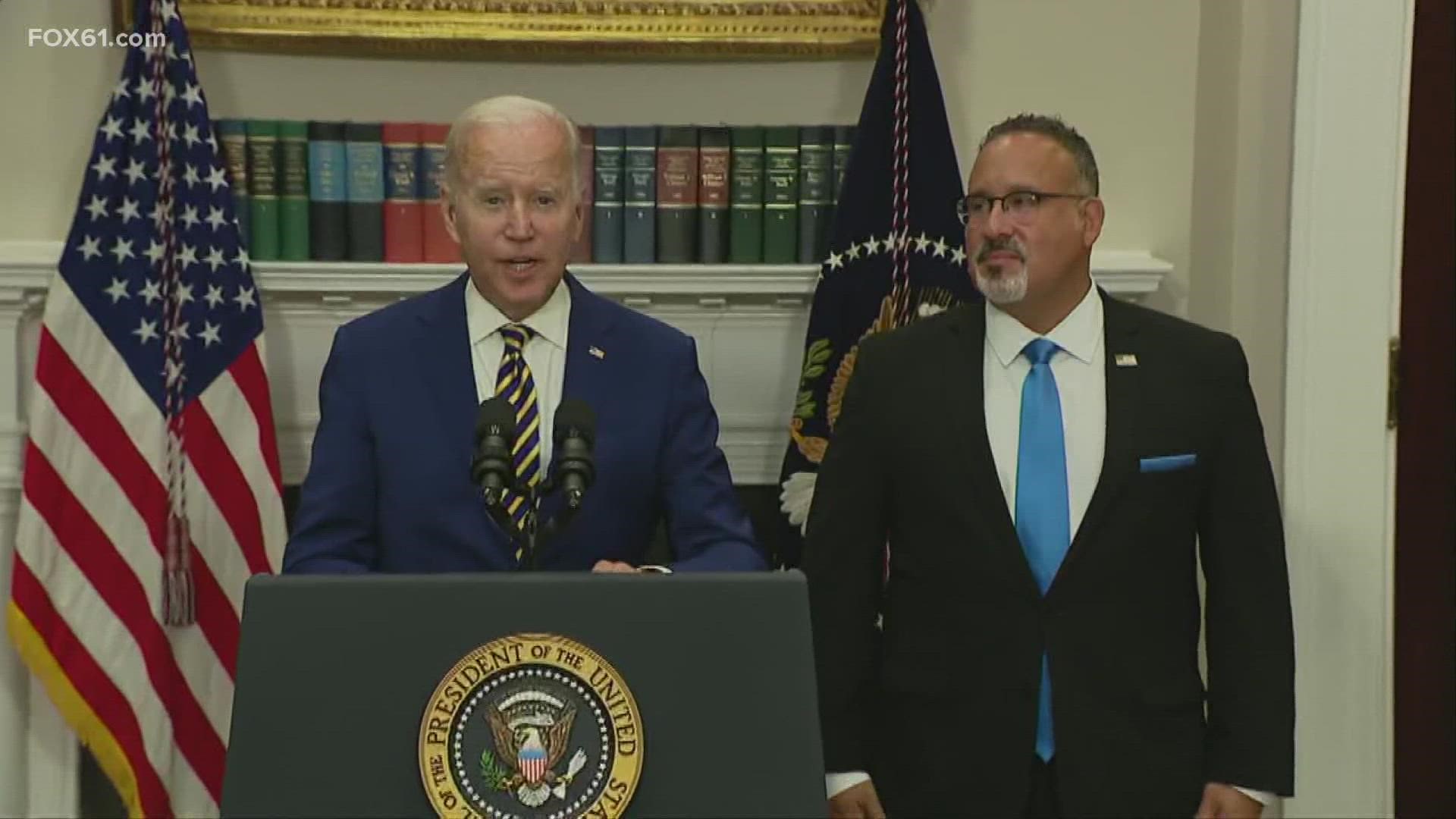

President Biden announced a plan Wednesday that would cancel up to $20,000 in student loan debts for borrowers who qualify based on income.

Under the plan, $10,000 dollars in student loan relief would be given to borrowers who make less than $125,000 or families earning less than $250,000. Pell Grant recipients can get $20,000 in relief.

The Biden administration also plans to extend the pause on federal student loan payments through the end of the year. Repayment for undergraduate loans would also be capped at 5% of monthly income.

“My son graduated from college a couple years ago. He’s a musician," Amy Stevenson from West Hartford said. "He really appreciated having this respite from paying his loans during COVID.”

Educator Amy Mahoney from West Hartford, who is paying back her loans, wishes the parameters for who qualifies would be wider.

“For people like us who are midcareer professionals, we, at this point, make too much money to qualify for it, even though to get to this point, we’ve had to accrue a lot of debt, multiple masters degrees or multiple graduate degrees to get here,” she said. “It certainly would have helped me 10 years ago, 15 years ago.”

You might be wondering: what happens if you’ve already paid off a chunk of your loans? The Director of Student Financial Aid at the University of Hartford said you can still get the benefits if you qualify.

“If the student doesn’t have $20,000, but they’re eligible up to that, at least they’re going to receive some portion of the loan cancellation," Katherine Presutti, Director of Student Financial Aid for University of Hartford, said.

The start date for the loan cancellation is unknown at this time, but Presutti said the application is expected to come out at some point before the end of the year.

You can sign up to be notified when the process begins on the government's student aid website by clicking here.

Elisha Machado is a reporter at FOX61 News. She can be reached at emachado@fox61.com. Follow her on Facebook, Twitter and Instagram.

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

----

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.