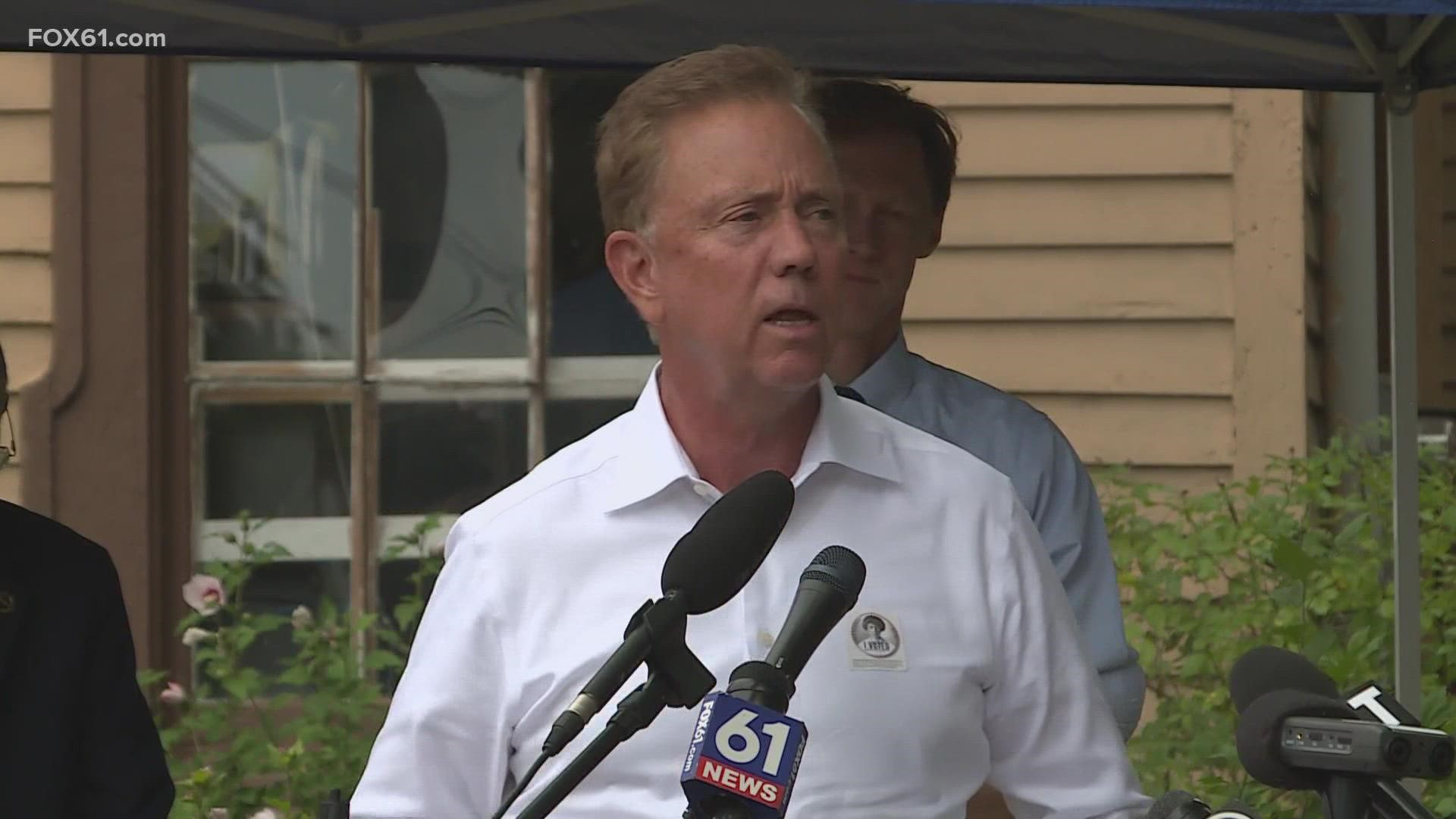

HARTFORD, Conn. — On Tuesday, Gov. Ned Lamont announced an increase in the state's Earned Income Tax Credit from 23% to 30.5%. The increase will impact thousands of residents and families.

According to Lamont's office, Connecticut's Earned Income Tax Credit is a refundable state income tax credit for low-to-moderate-income working families with or without children who qualify under special circumstances. It mirrors the federal earned income tax credit. Filers must have eligible earned income and an adjusted gross income that is less than to qualify:

- $51,464 ($57,414 married filing jointly) with 3 or more qualifying children

- $47,915 ($53,865 married filing jointly) with 2 qualifying children

- $42,158 ($48,108 married filing jointly) with 1 qualifying child

- $15,980 ($21,920 married filing jointly) with no qualifying children

“Increasing the rate of the Connecticut Earned Income Tax Credit is one of the most impactful provisions in the newly enacted state budget because it will provide direct relief to low-to-moderate income workers who are providing for their families,” Lamont said. “Numerous studies have shown that this tax credit is one of the best anti-poverty tools we can use because it encourages work, boosts economic stability, and uplifts generations to come. Ultimately, these tax credits improve entire communities because these dollars are being invested right back into our local economy through groceries, transportation, clothing, rent, utilities, and other necessary expenses. In this time of economic uncertainty for so many, we need to make sure Connecticut’s working families know about this tax credit and file taxes to claim it.”

The increase was included as part of the 2022-2023 state budget Lamont signed earlier this year. The governor's office says an additional $40 million will be delivered to the nearly 195,000 households that are eligible for the tax credit, totaling $158 million.

In 2020, approximately 175,000 households in the state, which included more than 220,000 children and other dependents, benefited from the credit.

“The Department of Revenue Services is proud to administer Connecticut’s Earned Income Tax Credit, which puts money back in the pockets of hard-working families,” Connecticut Department of Revenue Services Commissioner Mark D. Boughton said. “I applaud Governor Lamont and members of the General Assembly for their support of this important state tax benefit, and their investment in working families who continue to sustain Connecticut and contribute to our comeback.”

Created in 2011, Connecticut Earned Income Tax Credit has had varied rates over the last ten years, including 30% in 2011 and 2012, and 25% in 2013.

The governor's office says with a 30.5% rate, a family with two children will receive up to $1,824 in Connecticut. In comparison, they would receive $1,362 in 2020.

The newly enacted increase is higher than Massachusetts and New York, which both are at 30%.

---

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.